On July 19, 2021, one year after the death of Rep. John Lewis of Georgia, Representative Jim McGovern of Massachusetts became the new sponsor for the The Religious Freedom Peace Tax Fund bill. To affirm the religious freedom of taxpayers who are conscientiously opposed to participation in war, to provide that the income, estate, or gift tax payments of such taxpayers be used for nonmilitary purposes, to create the Religious Freedom Peace Tax Fund to receive such tax payments, to improve revenue collection, and for other purposes.

This bill directs the Department of the Treasury to establish in the Religious Freedom Peace Tax Fund for the deposit of income, gift, and estate taxes paid by or on behalf of taxpayers: (1) who are designated conscientious objectors opposed to participation in war in any form based upon their sincerely held moral, ethical, or religious beliefs or training (within the meaning of the Military Selective Service Act); and (2) who have certified their beliefs in writing.

Amounts deposited in the Fund shall be allocated annually to any appropriation not for a military purpose. Treasury shall report to the House and Senate Appropriations Committees on the total amount transferred into the Fund during the preceding fiscal year and the purposes for which such amount was allocated. The privacy of individuals using the Fund shall be protected.

See the Congress.gov official profile

Your tax dollars at work

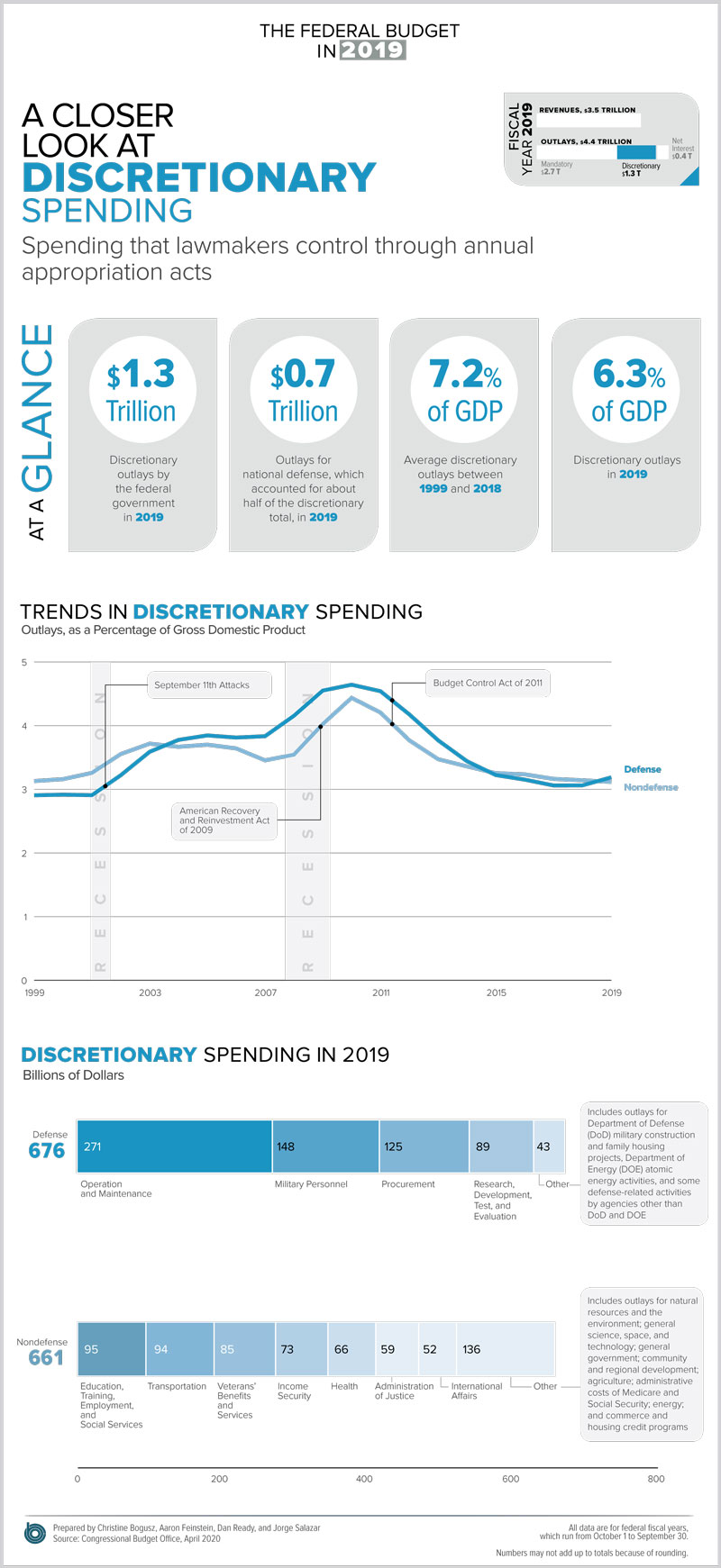

Discretionary spending of the federal government totaled $1.3 Trillion in 2019 and of that $676 Billion was used for military spending according to the Congressional Budget Office.

How the Peace Tax Fund Bill would work?

The Peace Tax Fund Bill would affect the “current military” portion of the U.S. budget. The Peace Tax Fund Bill would amend the Internal Revenue Code to permit taxpayers conscientiously opposed to participating in war to have their income, estate or gift tax payments spent for non-military purposes only. The Bill excuses no taxpayers from paying their full tax liability.

Where the Peace Tax Fund money would go?

The full federal taxes of conscientious objectors would be placed into a special trust fund in the Treasury, called the Religious Freedom Peace Tax Fund. The Treasury would be allowed to spend this money on any governmental program that does not fulfill a military purpose.